Purchasing Card Policy

In line with NSW Treasury Circular TC21-01 NSW Payments Digital Reform – Digital Payment Adoption which seeks to drive the utilisation of digital and contactless payment options across the NSW public sector, a NSW Government Purchasing Card (Pcard) may be used for official business purchase of low-value, irregular in nature, high volume procurement of goods and services to facilitate immediate payment to suppliers.

The purpose of this policy is to provide the conditions and framework to ensure effective management and compliance over the use of Pcards issued by the Department of Creative Industries, Tourism, Hospitality and Sport (DCITHS) in accordance with NSW Treasury Policy and Guidelines Paper TPP 21-02 Use and Management of NSW Government Purchasing Cards.

TPP 21-02 allows for Pcards to be provided to government officers where a legitimate ongoing business requirement can be demonstrated. Government officer has the same meaning as in section 2.9 of the Government Sector Finance Act 2018 (GSF Act) which include persons who are the head of, or are employed in or by, a GSF agency and statutory officers.

Scope

This policy applies to staff issued with a DCITHS Pcard. Permanent and temporary staff who are employed by DCITHS (Government officers) may apply for a Pcard.

Staff issued with a Pcard from Destination NSW and other agencies within the portfolio must adhere to their own Pcard policies and procedures.

It is not available to a person exercising functions for or on behalf of DCITHS, including all volunteers, consultants and contractors.

To be eligible for a Pcard, one or more of the following criteria must be met:

- purchase goods and services in the course of their duties

- travel frequently in the course of their duties

- travel overseas on official business.

Requests for a Pcard must be approved by a Senior Executive (PSSE Band 2) or equivalent.

Definitions

The Department – Department of Creative Industries, Tourism, Hospitality and Sport. This does not include Destination NSW or any agencies within the portfolio.

Pcard – Purchasing card

Senior Executive – a staff member employed as a Public Service senior executive under the Government Sector Employment Act 2013.

Policy

1. Limits

For a new Pcard, the default transaction limit is A$10,000, and the credit limit is A$10,000 per month, except for where there is a specific business request to set the credit limit lower than the default monthly limit of A$10,000.

Requests to increase monthly credit limits above the set value must be made in writing to, and approved by, the Chief Financial Officer. The transaction limit cannot be increased.

2. Key Responsibilities

Cardholders, their managers, and those involved in the administration of the Pcards share the responsibility of ensuring compliance with this policy and effective management of risks associated with the use of Pcards.

- use Pcards only for official purposes.

- ensure the safety and security of the Pcards at all times.

- obtain and retain relevant card receipts and other documents for all transactions. TPP 21-02 requires official tax receipts for all transactions over $30 (inclusive of GST). Where this is not possible, ensure alternative documents and/or explanation are provided to sufficiently support the transaction. Transactions without supporting documents will require a statutory declaration (an additional mandatory step included in the acquittal process in Expense8).

- ensure that the card’s transaction and monthly credit limits are not exceeded (purchases must not be split to negate single transaction limits).

- promptly acquit the transactions in the expense management system, Expense8, within 30 days of the transaction date.

- notify the card issuer, Citi, immediately in the following circumstances:

- loss or theft of the card

- on awareness that an authorised transaction has occurred.

- notify Finance as soon as practicable in the following circumstances:

- cessation of employment with DCITHS. All transactions must be acquitted and approved by the relevant manager prior to departure.

- where a card is no longer required because of a change in the cardholder’s substantive role or responsibilities.

- prolonged leave of absence (e.g., on personal leave or secondment).

- loss or theft of the card.

- on awareness that an unauthorised transaction has occurred.

- all purchasing activities by direct reports who are cardholders.

- prompt review and action (approve/reject) of the transactions in Expense8 within 30 days of the transaction date; providing reasons for rejecting transactions.

- notifying Finance, as soon as practicable in the following circumstances:

- where a card is no longer required because of a change in the cardholder’s substantive role or responsibilities.

- prolonged leave of absence (e.g., on personal leave or secondment).

- process Pcard applications.

- administer Pcard transactions in Expense8; reconciling with SAP General Ledger.

- provide assistance and guidance regarding card usage and the Expense8 process.

- review card activity to ensure:

- compliance with this Policy; imposition of card suspension and revocation for non-compliance.

- identify dormant or low use cards to recommend for cancellation.

- timely disablement of cards when a cardholder is on a prolonged leave of absence.

- instigate action where there is evidence of misuse (including possible unauthorised or fraudulent transactions).

- act as a point of contact between DCITHS and Citi, the card issuer.

3. Restrictions of Use

A Pcard is a mechanism and form of payment method only. Before using Pcards to make purchases, cardholders must first and foremost ensure compliance with relevant DCITHS’s policies and delegations. Key delegations and policies to observe are:

- Procurement Delegations: prescribe certain requirements in the procurement of goods or services, including pre-approval from an authorised delegate who is not the cardholder.

- Travel Policy: provide the parameters to incur expenses while undertaking official travel.

- Gifts, Benefits and Hospitality Policy: provide guiding principles in relation to gifts, benefits and hospitality being given or received.

- Financial Delegations: set the financial limits per transaction for cardholders.

Subject to the exclusions below, the purchases of goods and services must be made through NSW Government registered suppliers where applicable. Details of registered suppliers are available at https://buy.nsw.gov.au

Pcards can NOT be used for:

- cash withdrawals, except where this has been approved by the Secretary as part of an international travel request. Approved cash withdrawals are subject to the below limit:

- A$200 per transaction

- A$600 per month (billing cycle)

- the purchase of an ICT solution, including capital items, low value assets, and subscriptions for cloud-based services, without pre-approval by the appropriate delegate under the Procurement Delegation instrument.

- purchase of alcohol, whether as part of a meal or otherwise, except where:

- it is authorised under and complies with the Liquor & Gaming NSW Inspector Manual.

- it is approved in advance by the Secretary, a Deputy Secretary or CEO.

- Evidence of the above authorisation or approval must be attached to the transaction in Expense8.

- regular or periodic payments. These items should be arranged through a standing purchase order.

- the purchase of capital items or low value assets. Where possible, these items should be procured through NSW Government contract and paid for via an official agency purchase order.

- the purchase of any goods or services where the officer may/will gain private advantage (e.g., frequent flyer points, reward programs, etc.).

- the purchase of goods or services subject to alternative whole-of-government arrangements. For example, airline tickets must be obtained through the NSW Government contracted travel provider (FCM) unless exempted under the Travel Policy.

- professional services. These services must be purchased using a purchase order raised for the full period of the engagement.

- payment of expenses related to Departmental motor vehicles unless in emergency situations only. Fuel should be purchased using cards provided with the vehicle, if available, while repairs and servicing should be arranged through the fleet management provider, SG Fleet.

4. Record Keeping

The cardholder must provide full supporting documentation, including all receipts and explanatory notes to attach in Expense8 when acquitting the transactions. Merchant copies of card transactions are not receipts.

Explanatory notes should contain sufficient detail to enable managers approving the expenditure to be satisfied that business requirements for the purchase were legitimate.

Where the transaction was incurred for or on behalf of Government officers and non-Government officers, supporting documentation must clearly identify the proportionate split of the costs to allow for the calculation of any fringe benefit tax (FBT) liability.

5. Rejected Pcard Transactions in Expense8

Pcard transactions may be rejected by managers for various reasons including:

- lack of / incorrect supporting documents attached in Expense8

- purchase of goods or services of a kind that is not permitted by DCITHS

- purchase does not comply with DCITHS’s policy and/or delegation

- expenditure is more than the allowable limit (e.g., cost of a meal while travelling).

When a transaction is rejected, the cardholder is required to re-acquit / resubmit the transaction for approval by the manager again. The reason for rejection must be addressed on submission. For example, include / replace incorrect supporting document, or recode the transaction to a designated prohibited personal use general ledger account where the purchase is deemed to be non-business related.

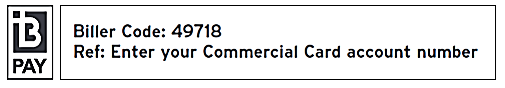

Cardholders are to reimburse DCITHS for rejected transactions which are determined to be personal expenses in nature. Repayments to DCITHS are to be made directly to the cardholder’s Pcard via Bpay.

If repayment via Bpay is not possible, contact DCITHS Finance via DCITHS-pcards@dciths.nsw.gov.au to arrange for an alternative method.

6. Breach of this Policy

As part of the responsibilities of the cardholders and managers, Pcard transactions must be promptly acquitted by the cardholder and approved by the manager within 30 days of each transaction. If transactions remain outstanding and no acceptable reason is submitted for non-compliance, the Pcard may be suspended until outstanding transactions are acquitted and approved. Sustained non-compliance with this policy will result in revocation of the Pcard.

Officers issued with a Pcard are in a position of trust regarding the use of public funds. Non-compliance with this policy, including any improper use of a Pcard may be determined to be misconduct and result in disciplinary action being taken in accordance with the Government Sector Employment Act 2013.

Contact

Chief Financial Officer

DCITHS Finance (Pcards)

Variation

The Department may amend this document as appropriate.

| Policy Owner | Last revision | Next review date | Summary of changes |

| Director, Financial Control & Reporting | October 2024 | October 2025 | References to Department of Enterprise, Investment and Trade updated to DCITHS. |